Brandly's Sales Tax Policy

Sales tax nexus is the legal requirement for a business to collect and remit sales tax in a specific state, typically based on factors like a physical presence, economic activity, or sales threshold within that jurisdiction. Brandly adds sales tax for only the states where we have physical or economic nexus.

Even if we do not collect sales tax from you, you may owe sales or use tax on your purchase. Unless the order is delivered to Alaska, Delaware, Montana, New Hampshire, or Oregon, your state most likely requires purchasers to report and pay tax on all purchases that are not taxed at the time of sale. For more information, please visit your state’s department of revenue website.

Tax Exempt Entities

Non-profits and charities are exempt from sales tax to support their mission-driven activities and minimize costs on purchases necessary for their charitable work.

Non-profits and charities

Please furnish us with your tax exemption certificate before processing to avoid sales tax charges on your online printing orders, email us your tax exemption or declaration letter to [email protected].

What is an IRS Declaration Letter?

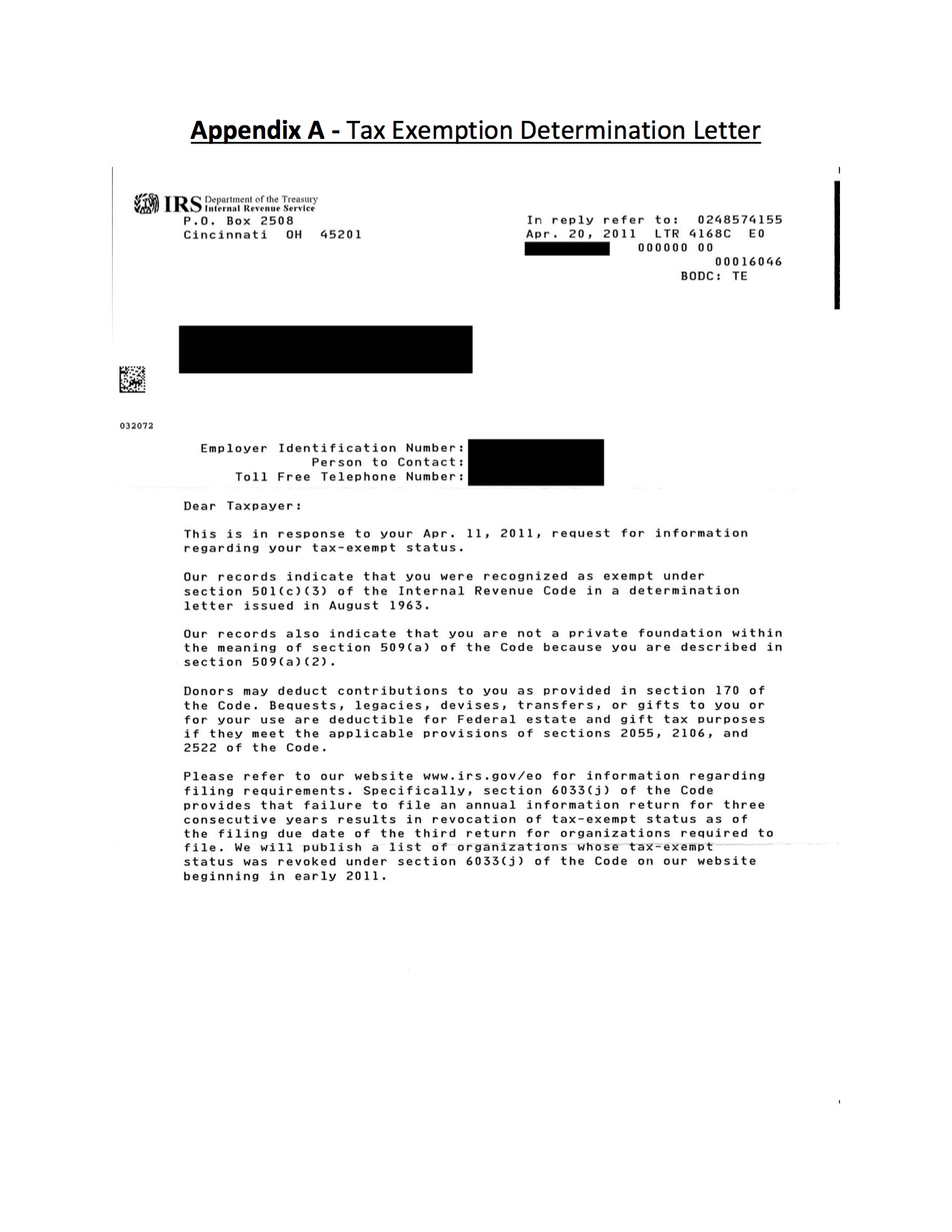

An IRS Declaration Letter, also known as a Letter of Determination or IRS Tax Exemption Letter, may be requested by some entities as an alternative way to verify your organization's tax-exempt status, particularly if you have 501(c) or 501(c)(3) tax-exempt status. If you need to provide this documentation, here is an example:

Tax Exemption Declaration Letter

Tax Exemption Declaration Letter

Brandly's Sales Tax Policy

-

Sales tax nexus is the legal requirement for a business to collect and remit sales tax in a specific state, typically based on factors like a physical presence, economic activity, or sales threshold within that jurisdiction. Brandly adds sales tax for only the states where we have physical or economic nexus.

function link() { [native code] }